The United Kingdom’s (UK) departure from the European Union (EU) marked a significant shift in trade regulations, particularly in Value Added Tax (VAT). Businesses, both within and outside the UK, have had to adapt to a new set of VAT rules that impact cross-border sales, import procedures, and overall tax compliance. These changes, which came into effect on January 1, 2021, are especially critical for overseas sellers who must navigate different VAT obligations depending on where their goods are located at the time of sale.

Understanding these VAT changes is crucial for businesses to remain compliant, avoid penalties, and optimize their operations. This article provides an in-depth look at the post-Brexit VAT landscape, offering clear insights into how these rules affect transactions involving UK-registered businesses, unregistered businesses, and online marketplaces.

Definition of Overseas Seller

According to HMRC, an overseas seller is a business that sells goods to UK customers but does not have a business establishment in the UK. A business is considered “established” in the country where its central administrative functions occur. An overseas seller can be defined in several specific scenarios:

Selling Goods Stored in the UK

If a business sells goods stored in the UK to customers in the UK but does not have a business establishment in the UK (e.g., no physical office, warehouse, or staff in the UK), it is considered an overseas seller. In this case, the business is deemed to have no UK establishment but still operates within the UK market.

Selling to Great Britain (England, Scotland, and Wales)

A business based outside the UK (including the EU or other non-EU countries) that sells goods to customers located in Great Britain (England, Scotland, and Wales), and then imports the goods into Great Britain, is considered an overseas seller. This applies whether or not the goods are stored in the UK.

Selling to Northern Ireland

A business based outside the UK and EU that sells goods to customers in Northern Ireland and then imports those goods into Northern Ireland is also classified as an overseas seller. This applies regardless of whether the goods are stored in Northern Ireland or Great Britain.

Additional Details on What Constitutes an Overseas Seller

No Physical Presence in the UK

The term “overseas” means that the business does not have a physical establishment or significant infrastructure within the UK. For example, if a business only has employees working remotely outside the UK or has a registered office located abroad, it would still be an overseas seller even if it is selling goods to UK customers.

VAT Registration

Overseas sellers may need to register for VAT (Value Added Tax)

Key VAT Changes for Overseas Sellers

For overseas sellers, VAT obligations differ based on whether goods are located inside or outside the UK at the time of sale. Given the complexity of the post-Brexit VAT system, businesses must carefully evaluate their VAT responsibilities, particularly when dealing with VAT-registered businesses, unregistered businesses, or direct consumers.

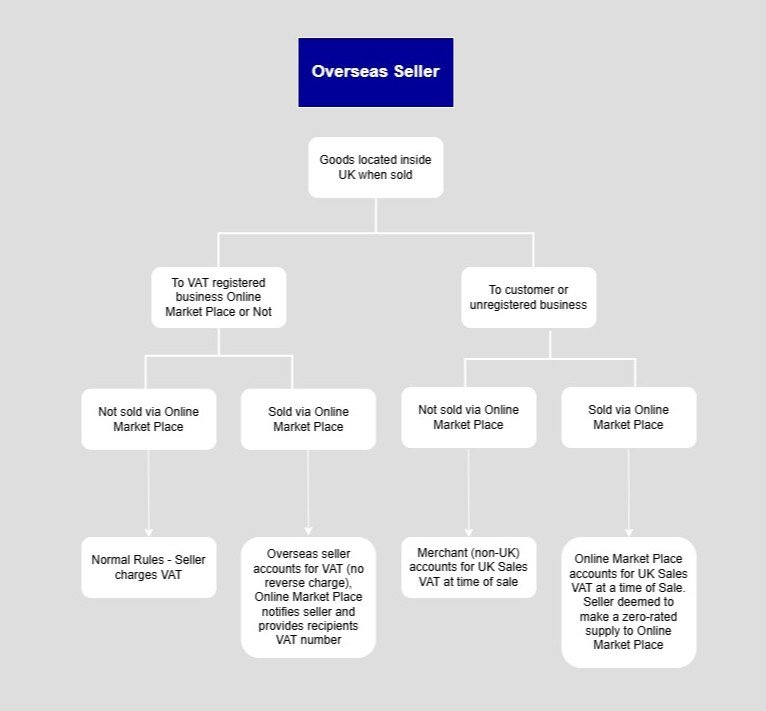

Goods Located Inside the UK When Sold

For goods already within the UK at the point of sale, VAT liability depends on the type of buyer and whether the transaction occurs via an Online Marketplace (OMP).

Sales to VAT-Registered Businesses

- Not Sold via Online Marketplace: The normal VAT rules apply, meaning the seller must charge and collect VAT from the buyer. The VAT-registered buyer can reclaim VAT as input tax if eligible.

- Sold via Online Marketplace: The overseas seller must account for VAT, and the OMP must notify the seller while providing the recipient’s VAT number. The VAT charge is handled by the seller, ensuring compliance with UK tax laws.

Sales to Customers or Unregistered Businesses

- Not Sold via Online Marketplace: The merchant (a non-UK business) is responsible for charging UK VAT at the point of sale and remitting it to HMRC.

- Sold via Online Marketplace: The OMP takes responsibility for charging and accounting for VAT at the point of sale. In this case, the seller is deemed to have made a zero-rated supply to the OMP, simplifying VAT compliance for overseas businesses.

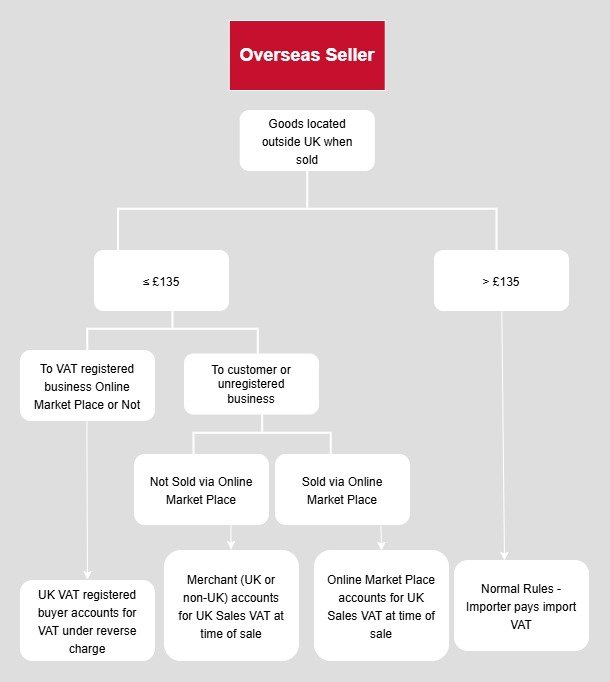

Goods Located Outside the UK When Sold

When goods are located outside the UK at the point of sale, VAT treatment differs based on the value of the goods being imported.

Goods Valued at £135 or Less

- Sales to VAT-Registered Businesses: The UK VAT-registered buyer accounts for VAT under the reverse charge mechanism, shifting the tax reporting obligation to the buyer rather than the seller.

- Sales to Customers or Unregistered Businesses:

- Not Sold via Online Marketplace: The merchant (UK or non-UK) must charge and account for UK Sales VAT at the point of sale before the goods are dispatched to the buyer.

- Sold via Online Marketplace: The OMP is responsible for charging and accounting for UK VAT at the time of sale, simplifying VAT reporting for sellers.

Goods Valued Over £135

Normal import VAT rules apply, meaning the importer (typically the buyer or the business receiving the goods) is responsible for paying VAT upon importation. The seller may need to ensure compliance with customs procedures and import documentation requirements.

Visual Representation of Post-Brexit VAT Rules

The following diagram provides a clear breakdown of how VAT obligations differ for overseas sellers based on whether the goods are inside or outside the UK at the time of sale. This flowchart illustrates the different VAT responsibilities for sellers, Online Marketplaces, and buyers under the post-Brexit VAT framework.

Definition of an Online Marketplace (OMP)

An Online Marketplace (OMP) is a digital platform—whether a website or mobile application—that facilitates the sale of goods or services between sellers and customers. The marketplace operates as an intermediary, providing the infrastructure for sellers to list products, manage transactions, and interact with customers.

According to HMRC, an online marketplace is defined as:

Any electronic interface (website or mobile application) such as a marketplace, platform, portal, or similar that facilitates the sale of goods to customers.

The key characteristics of an online marketplace include:

-

Sale of Goods or Services

The marketplace is used for selling goods or services, and the sales occur based on pre-established terms and conditions set by the marketplace.

-

Involvement in Ordering or Delivery

The platform is actively involved in ordering or delivering goods, ensuring that the transaction is carried out smoothly.

-

Facilitation of Payments

The marketplace either facilitates or authorises customer payments, acting as an intermediary in the payment process between the customer and the seller.

Exclusions from Online Marketplace Definition

A platform is not considered an online marketplace if it only provides certain services without involvement in the transaction process. These services include:

- Processing payments (without further involvement in the sale).

- Listing or advertising goods (without facilitating the sale).

- Redirecting customers to other websites or apps where goods are sold without their active involvement in completing the transaction.

How does VAT work for online marketplaces?

Online marketplaces may be held accountable for any unpaid VAT when sellers fail to comply with the rules. The VAT obligations for sales made through online marketplaces are intricate, as they depend on factors such as the location of the goods, the seller’s country of operation, and whether the customer is VAT-registered.

Important Steps for Online Sellers

Online sellers engaging in international business must proactively understand their new obligations to ensure compliance with updated regulations.

While it may seem overwhelming, here are some key actions you can take to stay on track:

-

Register for UK VAT

If you sell goods valued at £135 or less directly to UK consumers (private individuals or non-VAT registered businesses), ensure you register for a UK VAT number.

-

Apply for an EORI Number

You need an Economic Operator Registration and Identification (EORI) number to move goods between the UK and non-EU countries.

-

Know Your Commodity Codes

To apply the correct UK VAT rate, ensure your product descriptions are accurate and correspond to the appropriate Commodity Code. This will help you indicate the correct VAT rate on invoices.

-

Practice Good Record Keeping

Maintain detailed records of the goods you sell and ensure you have the necessary information to apply the right VAT treatment. This helps with ongoing compliance.

-

Selling to a UK VAT-Registered Business

If you're selling goods valued at £135 or less directly to UK VAT-registered businesses, obtain their VAT registration number and apply the reverse charge mechanism to account for VAT.

-

Selling Through a Marketplace

If you sell through an online marketplace like eBay or Etsy, the marketplace must register for UK VAT and handle the VAT obligations on your behalf.

-

Know the Rules and Consult with Your Accountant

Familiarize yourself with official UK government guidance, and consult a tax professional for any questions related to taxes, duties, customs, or other regulations

Reverse Charge Mechanism

The reverse charge mechanism is an essential aspect of post-Brexit VAT rules, especially for businesses purchasing goods from overseas sellers. Under this system, the responsibility for reporting and paying VAT shifts from the seller to the buyer, ensuring a more efficient tax collection process and reducing the risk of fraud.

How the Reverse Charge Mechanism Works?

The reverse charge mechanism applies when UK VAT-registered business purchases goods from an overseas seller. Instead of the seller charging VAT, the buyer self-accounts for both the input VAT, which is reclaimable, and the output VAT, which is payable, on their VAT return. This process ensures that the UK business does not have to pay VAT upfront, thereby improving cash flow while maintaining VAT compliance.

Example of the Reverse Charge Mechanism step by step

- Tech Trade Ltd operates an online platform that connects third-party sellers with buyers in the UK.

- When a customer places an order, they must accept Tech Trade Ltd.’s terms and conditions. The company processes the payment from the buyer, arranges the shipment of goods from the supplier, and handles customer inquiries. Due to these activities, Tech Trade Ltd qualifies as an Online Marketplace Provider (OMP).

- The platform mainly facilitates the sale of low-value electronic accessories, such as phone chargers, USB cables, and earphones. As these products are typically inexpensive, most orders have a value of less than £135.

- One of the suppliers selling via Tech Trade Ltd is based in Germany. When a UK VAT-registered business purchases goods, they are shipped directly from Germany to the UK buyer.

- Since the goods are located outside the UK at the point of sale (in Germany), they are classified as imports. The VAT treatment depends on the total consignment value.

- In this case, as the order value is below £135 and does not include excise goods, VAT is not applied at the border. Instead, UK domestic VAT rules come into effect. Since Tech Trade Ltd operates as an OMP, it is not required to charge or account for VAT, provided the buyer supplies a valid UK VAT registration number. This VAT number should be verified using HMRC’s online VAT number checker.

- Tech Trade Ltd should include a note on the invoice stating, ‘reverse charge: customer must account for VAT’ and send it to the UK business buyer.

- The responsibility for VAT accounting falls on the UK business, which must declare it under the reverse charge mechanism in its VAT return.

- The German supplier should issue an invoice to Tech Trade Ltd without including VAT.

Pre-Brexit vs post-Brexit VAT Rules

The Following table highlights key differences in VAT Treatment before and after Brexit:

| Aspect | Pre-Brexit (Before Jan 1, 2021) | Post-Brexit (From Jan 1, 2021) |

|---|---|---|

| VAT on Imports | No import VAT within the EU; goods moved freely without customs declarations. | Import VAT applies on all goods entering the UK from the EU; customs declarations are now required. |

| VAT on Exports to EU | Treated as intra-community supplies; zero-rated for UK VAT, with acquisition VAT accounted by the EU buyer. | Treated as exports; zero-rated for UK VAT. The EU buyer is responsible for import VAT and customs duties upon arrival. |

| Distance Selling Threshold | Applied within the EU; UK businesses had to register for VAT in the EU member state once thresholds were exceeded. | No longer applicable; UK businesses must register for VAT in each EU country they sell to, regardless of sales volume. |

| Online Marketplace (OMP) Liability | OMPs had no specific VAT obligations for facilitating sales. | OMPs are responsible for collecting and accounting for VAT on goods sold in the UK in consignments not exceeding £135. |

| Reverse Charge Mechanism | Applied to certain services and goods movements within the EU to shift VAT reporting from the seller to the buyer. | Extended to a broader range of services and goods from overseas suppliers; UK VAT-registered buyers account for VAT. |

Impact of Post-Brexit VAT Rules on Businesses

The post-Brexit VAT rules have had a substantial impact on businesses operating in or trading with the UK. Key changes in VAT treatment have introduced new administrative burdens, compliance requirements, and financial implications for businesses involved in cross-border transactions. Some of the impacts are:

Increased Administrative Burden

Businesses importing goods into the UK must now handle customs declarations, import VAT payments, and compliance with UK border regulations. Previously, goods moving freely within the EU did not require such formalities, reducing paperwork and administrative costs.

Cash Flow Challenges

With the introduction of import VAT on EU goods, businesses importing goods into the UK now face an additional financial strain. Companies must either pay VAT upfront or apply for postponed VAT accounting, which allows them to declare and recover VAT on the same VAT return.

Compliance with Overseas VAT Registrations

For UK businesses selling to EU customers, the abolition of the EU distance selling threshold means they must register for VAT in each EU country where they exceed the local registration threshold. This increases compliance costs, requiring businesses to manage multiple VAT registrations, returns, and payments.

Impact on Online Marketplaces and E-commerce Sellers

Under the new rules, Online Marketplaces (OMPs) are responsible for collecting VAT on sales of goods valued at £135 or less. This simplifies VAT collection for UK tax authorities but shifts compliance responsibility to digital platforms, requiring overseas sellers to adhere to OMP VAT rules.

Increased Use of the Reverse Charge Mechanism

The extension of the reverse charge mechanism means that UK VAT-registered businesses purchasing from overseas suppliers must self-account for VAT. While this simplifies tax reporting for overseas sellers, it places additional VAT compliance obligations on UK businesses.

Potential for Trade Barriers and Supply Chain Delays

The reintroduction of customs checks and VAT requirements for EU-UK trade has caused delays in supply chains. Businesses must ensure they have the correct VAT documentation and customs clearance procedures to prevent disruptions in the movement of goods.

VAT Registration Process for Overseas Sellers

- Appointing a VAT Representative

The overseas trader can choose to appoint a VAT representative, who will share joint and several liability for any VAT debts. The overseas trader must complete the VAT registration form even with a representative. Additionally, HMRC can require overseas businesses selling goods in the UK via a UK online marketplace to appoint a UK-based VAT representative. - Appointing an Agent

The overseas trader may hire an agent to handle their VAT affairs. Unlike a representative, the agent is not held responsible for any VAT debts to HMRC, and HMRC reserves the right to reject certain agents. The overseas trader must still submit a VAT registration form and provide a letter of authority to HMRC. - Managing VAT Obligations Directly

The overseas trader may choose to manage their VAT obligations, including registration, submitting returns, and maintaining records, without appointing a representative or agent.

Conclusion

The post-Brexit VAT changes introduce a complex framework for businesses involved in UK trade. Overseas sellers must carefully navigate the rules depending on where their goods are located at the point of sale and the value of the items sold. Businesses must ensure they are VAT-compliant, whether selling directly, through an Online Marketplace, or importing goods into the UK.

To remain compliant and competitive, businesses should seek professional VAT advice, implement robust VAT accounting systems, and monitor any further regulatory updates from HMRC. Understanding and adhering to these new rules is crucial for maintaining smooth operations and avoiding unnecessary tax liabilities.