VAT returns are critical for UK business compliance, yet many find them challenging. These quarterly submissions to HMRC determine how much VAT a business owes or can reclaim, directly affecting cash flow and operations. The digital transformation of tax compliance has introduced new requirements for record keeping and submission processes. Meanwhile, HMRC continues to strengthen its enforcement approach, making accuracy and timeliness essential for avoiding penalties and maintaining good standing.

Understanding the fundamentals of VAT return preparation can save businesses significant time, money, and stress. This guide provides the essential knowledge you need to file accurate returns confidently and avoid costly mistakes.

Understanding VAT Return Obligations

Before diving into the mechanics of completing VAT returns, it’s essential to understand who must file them and when. VAT return obligations vary depending on your business structure, turnover, and chosen accounting schemes. Getting the basics right from the start helps ensure you meet all deadlines and avoid unnecessary penalties.

Who Must Submit Returns?

All VAT-registered businesses must submit periodic returns to HMRC, regardless of their trading activity level or whether they owe VAT. This obligation continues even during periods of dormancy or when claiming refunds. The requirement applies to sole traders, partnerships, limited companies, and other business structures once they exceed the registration threshold (£90,000 as of 2025/26) or register voluntarily.

Return Periods and Timing

Most businesses file quarterly returns, with HMRC assigning each business to one of three stagger groups to distribute filing workload throughout the year. This system prevents all businesses from submitting returns simultaneously, helping HMRC manage processing efficiently. Your stagger group determines your quarter-end dates:

Stagger Group 1: 31 March, 30 June, 30 September, 31 December

Stagger Group 2: 30 April, 31 July, 31 October, 31 January

Stagger Group 3: 31 May, 31 August, 30 November, 28/29 February

HMRC typically assigns stagger groups automatically when you register for VAT, though businesses can sometimes request changes for genuine commercial reasons, such as aligning with their financial year-end.

Alternative arrangements include monthly returns for businesses regularly claiming VAT refunds, which can significantly improve cash flow by accelerating repayment timing. Annual returns are available under the Annual Accounting Scheme for qualifying smaller businesses, offering reduced administrative burden but with stricter payment requirements throughout the year.

Making Tax Digital Requirements

The introduction of Making Tax Digital has fundamentally changed how businesses approach VAT compliance. This digital initiative requires most VAT-registered businesses to maintain digital records and submit returns through compatible software, moving away from traditional paper-based systems.

Digital Record Keeping Standards

Under MTD, businesses must maintain digital records of all VAT transactions using compatible software. This means recording essential details including business information, VAT schemes used, and transaction-specific data such as supply dates, values excluding VAT, and applicable VAT rates. The software must create digital links between systems, preventing manual copying of figures between different programs.

Exemptions from Digital Filing

Although most businesses must comply with MTD requirements, certain exemptions exist for those facing genuine difficulties. These include businesses undergoing formal insolvency procedures, those operated by individuals whose religious beliefs prevent computer use, or situations where digital compliance proves impractical due to age, disability, limited digital skills, or poor internet connectivity.

Special Business Scenarios

Different types of businesses and accounting arrangements face unique challenges when implementing MTD requirements. Understanding how the digital rules apply to specific business models and VAT schemes ensures proper compliance while minimizing administrative burden. These scenarios often require tailored approaches to record keeping and may have different requirements for what must be recorded digitally versus what can remain in manual format.

Retailers Using VAT Retail Schemes

Retailers that process a high volume of low-value transactions often use retail schemes to simplify VAT reporting. Instead of recording each individual sale:

- Businesses can record Daily Gross Takings (DGT) in their digital records.

- These records must still show a breakdown of VAT by the relevant rates (e.g., standard, reduced).

This helps retailers stay compliant with MTD without being overwhelmed by the volume of sales data.

Flat Rate Scheme

Under the Flat Rate Scheme, businesses pay a fixed percentage of their turnover as VAT, rather than tracking input and output VAT on every transaction.

Key digital record-keeping points:

- Only sales need to be recorded digitally, unless the business purchases capital expenditure goods where input VAT can be reclaimed.

- There is no need to keep a digital record of goods used to determine whether the business meets the limited cost trader conditions.

This makes MTD simpler for small businesses using the flat rate method.

Margin Schemes

Margin schemes (e.g., second-hand goods, art, antiques) allow businesses to pay VAT only on the difference between purchase and sale price.

Under MTD:

- The margin calculations do not need to be stored digitally.

- However, manual records must still be maintained as supporting evidence.

- If digital software does not support margin VAT entries, businesses may record sales using a flat rate and make a manual adjustment at the end of the period.

This flexible approach ensures compliance while accommodating limitations in software functionality.

Completing Your VAT Return

Understanding the structure and requirements of VAT returns helps ensure accurate completion and reduces the likelihood of errors. Each return consists of nine boxes requiring specific information about your business transactions during the accounting period.

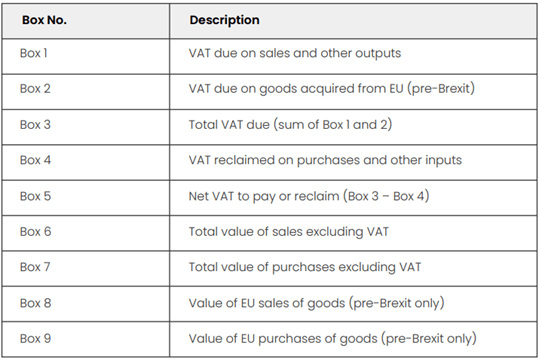

The Nine Box Structure

The VAT return follows a standardized format across all businesses:

Most modern returns include figures only in Boxes 1, 3, 4, 5, 6, and 7, with EU-related boxes primarily relevant for Northern Ireland businesses due to the Protocol arrangements.

Practical Example

Consider ABC Limited, a stagger group 1 business with a quarter ending 31 March 2025:

Sales during the quarter:

- Standard-rated sales: £50,000 + £10,000 VAT = £60,000 total

- Zero-rated exports: £20,000 (no VAT)

Purchases during the quarter:

- Office supplies: £2,000 + £400 VAT = £2,400 total

- Equipment: £5,000 + £1,000 VAT = £6,000 total

- Zero-rated purchases: £1,000 (no VAT)

VAT Return completion:

- Box 1: £10,000 (VAT on standard-rated sales)

- Box 2: £0 (no EU acquisitions)

- Box 3: £10,000 (total VAT due)

- Box 4: £1,400 (VAT reclaimable on purchases)

- Box 5: £8,600 (net VAT to pay to HMRC)

- Box 6: £70,000 (total sales excluding VAT)

- Box 7: £8,000 (total purchases excluding VAT)

- Box 8: £0 (no EU sales)

- Box 9: £0 (no EU purchases)

The business must submit this return and pay £8,600 to HMRC by 7 May 2025.

Submission Process and Deadlines

Timely submission of VAT returns remains crucial for maintaining compliance and avoiding penalties. The deadline structure varies depending on your chosen accounting arrangements and submission method.

Filing Deadlines

For most quarterly returns, the deadline falls one calendar month and seven days after the period end. For example, if your VAT period ends on 31 March, your return and any payment must reach HMRC by 7 May. This deadline applies to both return submission and VAT payment, making cash flow planning essential for businesses with significant VAT liabilities.

Annual Accounting Scheme users face different requirements. Instead of the standard one month plus seven days, you then get 2 months from the end of your VAT year to submit the annual return and make any balancing payment. This tighter deadline reflects the scheme’s different payment structure, where businesses make interim payments throughout the year followed by a final balancing settlement.

Penalties and Consequences

HMRC operates strict penalty regimes for both late filing and late payments. Understanding these consequences helps businesses prioritize compliance and avoid unnecessary financial burdens.

Late Filing Penalties

The penalty system operates on a points-based approach:

- First Late Return: You may receive one penalty point

- Subsequent Late Returns: Each late quarterly return may earn another penalty point

- After Four Points: Once you have four penalty points from quarterly returns, a financial penalty of £200 may be imposed

- Continuing Non-compliance: Every time you file a quarterly return late after reaching four penalty points, you may incur an extra £200 penalty

Important notes:

- Individual penalty points expire after two years (if the maximum threshold hasn’t been reached)

- If you file twelve consecutive monthly returns or four consecutive quarterly returns on time, your penalty points will reset to zero. This requires a continuous period of 12 months of compliant filing.

- HMRC may waive penalties if you have a reasonable excuse

Late Payment Penalties

The payment penalty system has two stages:

Fixed Penalties:

- No penalty if you pay within 15 days after the due date

- If you pay between 16 and 30 days late: 3% of the amount still unpaid at day 15

- If you pay 31 days or more late: 3% of the amount due at day 15, and another 3% of the amount still unpaid at day 30 (total penalty of 6% if nothing paid by day 30)

Daily Penalties:

- From day 31 onwards, a daily penalty applies at 10% per year on the unpaid balance

Interest is charged from the original due date at Bank of England base rate + 4%

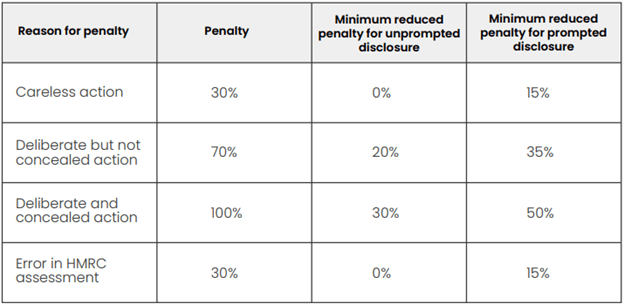

Penalties for Inaccurate Tax Returns

Submitting an inaccurate VAT return can result in significant penalties based on the severity of the error:

The penalties are expressed as a percentage of the Potential Lost Revenue (PLR).

Best Practice Recommendations

To minimize the risk of VAT errors and penalties, businesses should:

- Seek Professional Advice: Work with qualified accountants or tax advisers to ensure accurate VAT reporting and proper planning

- Stay Informed: Keep up to date with VAT regulations and HMRC updates to remain compliant as rules evolve

- Use Reliable Resources: Make use of HMRC’s official tools and guidance to support accurate VAT submissions and record-keeping

Conclusion

VAT return compliance requires understanding digital record keeping requirements, accurate completion of return boxes, and adherence to strict filing deadlines. The introduction of Making Tax Digital has transformed the compliance landscape, requiring most businesses to adopt compatible software systems while maintaining comprehensive digital records.

Success in VAT compliance depends on establishing robust systems that integrate with your business operations while meeting HMRC’s digital requirements. At Sterling & Wells, we provide comprehensive VAT compliance services, helping businesses navigate MTD requirements, complete accurate returns, and maintain proper records. Our experienced team ensures you meet all deadlines while minimizing penalty risks, allowing you to focus on growing your business with confidence.